Can banking takeovers and rescues stabilize the markets?

Clip: 3/20/2023 | 6m 6sVideo has Closed Captions

Can banking takeovers and rescues stabilize the markets?

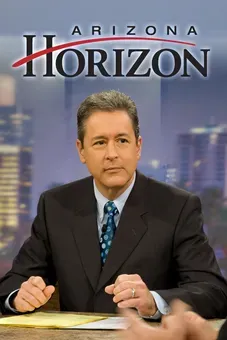

Ten days after the collapse of Silicon Valley Bank and emergency measures to stabilize the system, key parts of the banking industry are still reeling and anxious. UBS agreed to buy out its rival Credit Suisse for a fraction of its market value, and there were new efforts Monday to help stabilize First Republic Bank. Roben Farazad of Full Disclosure discussed the latest with Geoff Bennett.

Problems with Closed Captions? Closed Captioning Feedback

Problems with Closed Captions? Closed Captioning Feedback

Major corporate funding for the PBS News Hour is provided by BDO, BNSF, Consumer Cellular, American Cruise Lines, and Raymond James. Funding for the PBS NewsHour Weekend is provided by...

Can banking takeovers and rescues stabilize the markets?

Clip: 3/20/2023 | 6m 6sVideo has Closed Captions

Ten days after the collapse of Silicon Valley Bank and emergency measures to stabilize the system, key parts of the banking industry are still reeling and anxious. UBS agreed to buy out its rival Credit Suisse for a fraction of its market value, and there were new efforts Monday to help stabilize First Republic Bank. Roben Farazad of Full Disclosure discussed the latest with Geoff Bennett.

Problems with Closed Captions? Closed Captioning Feedback

How to Watch PBS News Hour

PBS News Hour is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipGEOFF BENNETT: Ten days after the collapse of Silicon Valley Bank and emergency measures from the federal government to stabilize the system, key parts of the banking industry are still reeling and anxious.

This weekend, Switzerland's largest bank agreed to buy out its rival, Credit Suisse, for a fraction of its market value.

And there were new efforts today to help stabilize First Republic Bank.

We're joined now by Roben Farzad, host of public radio's "Full Disclosure."

It's great to see you.

ROBEN FARZAD, Host, "Full Disclosure": Thank you, Geoff.

GEOFF BENNETT: And let's talk about the demise of Credit Suisse.

Overnight, a 167-year-old institution is dead, sold in a fire sale to its biggest rival.

Why should Americans care about what's happening with Credit Suisse?

And what does all of this suggests about the stability of the global banking system?

ROBEN FARZAD: I mean, granted, I mean, this was the C student of international investment banking, and yet it was a student of investment banking internationally.

And that's all interconnected with the other systemically important too-big-to-fail banks.

So, after we had experienced what we did here with Silicon Valley and that little mini bank panic, all eyes suddenly looked across the Atlantic for kind of weak players.

That's just the way this works in social media.

What about this guy?

What about that guy?

What about that guy?

Show us your balance sheet.

And, immediately, they realized that Credit Suisse could not stand on its own two feet.

And the government there in Europe, I think there was a lot of suasion to force what effectively is a shotgun take-under, a merger.

You saw something like that with J.P. Morgan and Bear Stearns back in 2008, when it was bought for $2 a share, and they got the headquarters near Grand Central.

And this was largely to telegraph that, look, we're on top of this crisis as well.

But yet all eyes again are back on the United States.

GEOFF BENNETT: Yes.

Well, let's talk about domestic banks, because J.P. Morgan right now is reportedly advising First Republic on next steps.

You have got the New York Community Bank.

They have agreed to by a significant chunk of the failed Signature Bank.

For the last 15 years, regulators have been focused on these banks that are deemed too big to fail as posing the greatest risks to the financial system.

Were they blinded to the threat, potential threat, posed by these smaller regional lenders?

ROBEN FARZAD: In fairness, these smaller regional lenders, these sub-regional banks, if you will, they were able to fly somewhat under the radar because of this deregulation, this impulse that you had in 2017 and 2018.

The cry back then was, we really can't make money with these onerous Dodd-Frank rules.

Why don't you give us a break?

Donald Trump was president that.

Everybody had forgotten about 2008 and 2009, when, in truth, there was a whole other risk coming down the pike.

It wasn't about rolling subprime debt and toxic assets on Wall Street.

It was about interest rate risk and being pretty with grabbing yield in this case.

And it was something that it's amazing to people that a bank that was so big and so flush with deposits and so reputable as Silicon Valley Bank could kind of blink.

And everybody's asking, where were the regulators, where, in reality, they kind of flew under the radar.

GEOFF BENNETT: A question about Silicon Valley Bank, because the decision by the federal government to make all of those depositors whole... ROBEN FARZAD: Right.

GEOFF BENNETT: ... even those folks who had well above the $250,000 amount that's insured by the FDIC, it sets a precedent.

And there's this question of, is what's good for thee good for me?

Why not just ensure all of the deposits?

ROBEN FARZAD: Because it's kind of an unthinkable taboo.

Nobody knows what it would cost.

It's not like the Fed and FDIC and Treasury and everybody is going to get together and write a $30 trillion check or transfer payment to the banking system.

I don't know the number above $250,000, the percentage of overall U.S. deposits that are uninsured, but just the telegraphing of it, just the suasion might be enough, especially in this era of Zelle and Twitter and frictionless transfers and going on your phone and moving something from a regional bank to a too-big-to-fail bank, to kind of forestall that, like, calm down, because this is a crisis of confidence, first and foremost.

Again, it's not toxicity.

It's not malfeasance.

It was a question of, are there -- it's inside baseball?

Are there mark-to-market losses?

And might there be a run on my bank?

And if enough people echo that, then the fear becomes reality.

And so the Fed wanted to put a psychological wall in front of that.

And I know I mixed 3,000 metaphors.

(LAUGHTER) ROBEN FARZAD: But I try to explain this to my parents and my relatives who call.

And that's really where we are right now.

GEOFF BENNETT: What is the Fed to do?

And what are they going to do next?

I mean, up until now, they have tried to balance or had to balance growth and inflation.

Now they have got to navigate growth, inflation and the financial stability of the banking sector.

ROBEN FARZAD: That's right.

GEOFF BENNETT: How does that work?

ROBEN FARZAD: And it's not like you have two interest rates.

It's not like you have one for hospitality and the two hot parts of the economy and real estate speculation and another special one for the banks.

You do have kind of backdoor facilities with the Fed and liquidity channels, and we will help you warehouse bonds and kind of if you need ample liquidity.

The Fed's balance sheet is swelling real time with this, but it was up until two, three weeks ago laser-focused on inflation.

And that's very hard to do when you have a banking crisis.

So now there are concerns that, if they come out and don't hike rates, people are going to be like, oh, that's worse than hiking by a quarter-point.

Maybe they know something we don't know.

So the steady hand theory, at least that was today's Wall Street digest.

Who knows what people are going to romance tomorrow or the day after?

It's a treacherously difficult thing to do... GEOFF BENNETT: Exactly.

ROBEN FARZAD: ... and I think a function of unprecedented stimulus that we have that the Fed is trying to put back into the bottle.

GEOFF BENNETT: So, bottom line question in plain English for folks who have their money stored away in just the bank down the street.

Do they have reason to be concerned?

ROBEN FARZAD: If you are above $250,000.

And, again, it's not because your Daddy Warbucks or anything, but you might have working capital or a small business.

It makes sense to read the fine print.

Oftentimes, if it's a joint account with a spouse, you are protected.

Read the fine print.

Ask.

Don't transfer first and ask questions later.

Very rarely in history have depositors taken a haircut.

The system doesn't want there to be an overall run on the system.

And you don't need to lose sleep at night about it.

GEOFF BENNETT: Yes, more to come.

Roben Farzad following it all, thanks so much.

ROBEN FARZAD: Thank you, Geoff.

The charges Trump may face in New York hush-money case

Video has Closed Captions

Clip: 3/20/2023 | 6m 19s | The charges Trump may face in hush-money case and where other investigations stand (6m 19s)

Chinese President visits Putin amid increase in cooperation

Video has Closed Captions

Clip: 3/20/2023 | 8m 13s | Chinese president visits Putin in Russia as the countries increase cooperation (8m 13s)

Climate scientists warn steps needed to prevent catastrophe

Video has Closed Captions

Clip: 3/20/2023 | 6m 59s | UN scientists warn drastic steps needed to prevent climate change catastrophe (6m 59s)

Hostage sabotage claim changes history of Carter presidency

Video has Closed Captions

Clip: 3/20/2023 | 7m 34s | New claim about Iran hostage crisis sabotage may change narrative of Carter presidency (7m 34s)

How Iraq war still impacts lives of veterans and families

Video has Closed Captions

Clip: 3/20/2023 | 9m 21s | How Iraq war still impacts lives of American Marines and families 20 years later (9m 21s)

Remembering choreographer and dancer Stuart Hodes

Video has Closed Captions

Clip: 3/20/2023 | 3m 51s | Remembering choreographer and dancer Stuart Hodes (3m 51s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipSupport for PBS provided by:

Major corporate funding for the PBS News Hour is provided by BDO, BNSF, Consumer Cellular, American Cruise Lines, and Raymond James. Funding for the PBS NewsHour Weekend is provided by...